With the busy festive season approaching, HM Revenue and Customs (HMRC) is calling on the North West’s 967,000 Self Assessment customers not to miss the 31 January deadline.

The 2019-20 tax return can be finalised at any time up to the deadline but HMRC is encouraging customers to complete it early to allow for more time to pay their tax bill or set up a payment plan.

Customers must complete a Self Assessment return if:

· they’ve earned more than £2,500 from renting out property

· they’ve received, or their partner has received, Child Benefit and either of them had an annual income of more than £50,000

· they’ve received more than £2,500 in other untaxed income, for example from tips or commission

· they are a self-employed sole trader whose annual turnover is over £1,000

· they are an employee claiming expenses in excess of £2,500

· they have an annual income of over £100,000

· they have earned income from abroad that they need to pay tax on.

HMRC’s Interim Director General of Customer Services, Karl Khan, said: “The 31st January deadline for tax returns is still a few weeks away, but customers don’t have to wait until then. We’re encouraging them to beat the busy January rush and get their tax returns in now.

“We know that many people are affected by the coronavirus pandemic this year and we’re here to help if they need to spread the cost of their tax bill. It’s quick and easy to set up a payment plan online and there’s no need to call us to set it up.”

Once Self Assessment customers have completed their 2019-20 tax return, and know how much tax is owed, they can set up their own payment plan to help spread the cost of their tax liabilities, up to the value of £30,000. They can use the self-serve Time to Pay facility to set up monthly direct debits and this can all be done online. Interest will be applied to any outstanding balance from 1 February 2021. To find out if they’re eligible, customers can visit GOV.UK to learn more about the service.

Customers can also now check on GOV.UK whether they need to declare, or possibly pay tax, on any ‘casual’ income they receive. The new interactive guidance is quick and easy to use and explains what individuals need to do if they receive non-PAYE income from:

• selling things, for example at car boot sales or auctions, or online

• doing casual jobs such as gardening, food delivery or babysitting

• charging other people for using your equipment or tools

• renting out property or part of their home, including for holidays (for example, through an agency or online).

Ten arrested for drugs offences following warrants in Chester

Ten arrested for drugs offences following warrants in Chester

Suspended prison sentence and indefinite ban for Cheshire man who abused his dog

Suspended prison sentence and indefinite ban for Cheshire man who abused his dog

Recovered Stolen Items

Recovered Stolen Items

Man charged in relation to courier fraud

Man charged in relation to courier fraud

Police to target criminal use of Cheshire’s roads

Police to target criminal use of Cheshire’s roads

Appeal for help in tracing wanted Ellesmere Port man

Appeal for help in tracing wanted Ellesmere Port man

Council awarded Gold Armed Forces Award

Council awarded Gold Armed Forces Award

Appeal for footage and witnesses following collision in Delamere

Appeal for footage and witnesses following collision in Delamere

Appeal for information following serious collision in Chester

Appeal for information following serious collision in Chester

Your chance to get involved in police scrutiny meetings

Your chance to get involved in police scrutiny meetings

New Events at Jodrell Bank

New Events at Jodrell Bank

Inspiring Futures at The Queen’s School

Inspiring Futures at The Queen’s School

Bowmere Hospital celebrates 20 years of mental health care

Bowmere Hospital celebrates 20 years of mental health care

Man charged with burglary and drug offences following Chester police stop check

Man charged with burglary and drug offences following Chester police stop check

Vicars Cross Road closed following collision in Chester

Vicars Cross Road closed following collision in Chester

Man jailed for controlling and coercive behaviour and assault

Man jailed for controlling and coercive behaviour and assault

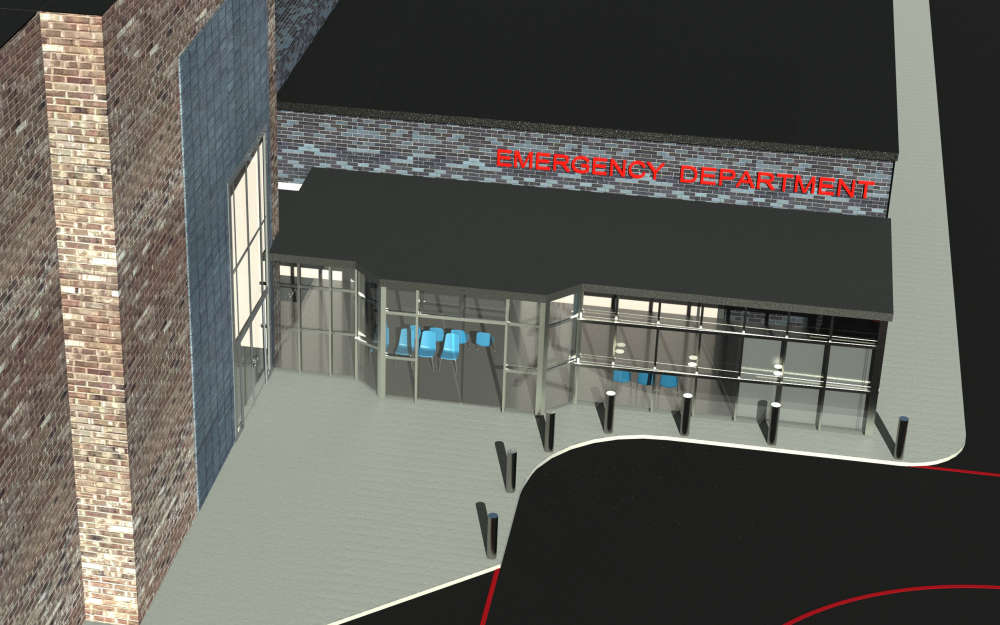

Plan unveiled to transform and improve emergency care at Countess of Chester Hospital

Plan unveiled to transform and improve emergency care at Countess of Chester Hospital

Chester & Wirral Football League - Weekend Round Up

Chester & Wirral Football League - Weekend Round Up

Ladbrokes returns to Chester Racecourse

Ladbrokes returns to Chester Racecourse

Blues Match Report: Chester FC 1 - 1 Curzon Ashton

Blues Match Report: Chester FC 1 - 1 Curzon Ashton