New data from the Federation of Small Businesses (FSB) has underscored the threat posed to millions of livelihoods by a sudden retraction of support for small firms in the weeks ahead.

FSB’s latest survey of 5,471 small business owners across the UK finds that 44% of North West businesses (41% at UK level) have been forced to close since the beginning of the coronavirus outbreak in the UK. Of those that have closed, 38% of NW businesses (35% at UK level) are not sure whether they will ever reopen again.

For those small businesses paying a mortgage or lease on their premises, 34% of NW businesses (28% at UK level) have failed to make, or faced severe difficulties in making, rent or mortgage repayments as a result of the pandemic’s economic impacts. 27% of NW businesses (25% at UK level) have had to shelve product development plans. Among NW exporters, one in four (21% at UK level) say they have had to either reduce or cancel international sales.

In response to the strain being placed on them, 41% of NW small employers (37% at UK level) are considering, or have already made, redundancies.

74% of small employers across the NW (71% at UK level) have furloughed staff to aid the survival of their business, illustrating the extent to which the Job Retention Scheme has protected the livelihoods of millions as economic activity has slumped.

As initial efforts are made to switch the economy back on, 70% of these NW businesses (74% at UK level) say the ability to partially furlough workers would benefit them. Of these, 47% of NW businesses (50% at UK level) say they want to bring staff back gradually, and 34% (31% at UK level) say it would keep their business viable.

FSB’s NW Regional Chair Chris Manka said: “The impact of the coronavirus pandemic has been felt right across the small business community. Government has stepped-up with a huge range of support for millions of small businesses and sole traders, from income support schemes, to cash grants, to help with accessing finance and business rates breaks.

“Policymakers now need to realise the economy will not go from zero to a hundred overnight once we’re into the recovery phase. The crucial support that’s on offer needs to be kept under review, and adapted to reflect the new normal as we chart a course back to economic recovery.

“Take the Job Retention Scheme. A big chunk of small business owners who have saved jobs by making use of it say that the ability to furlough staff on a part-time basis – allowing them to work according to client demand and gradually come back into the workplace, whilst being supported by the scheme the rest of the time – will not only be helpful, it will save firms. Part-time furloughing is not a nice to have, it’s fundamental to saving jobs.”

The new study also highlights those within the small business and self-employed community that have struggled to access government-initiated support.

Among small firms that pay business rates, close to one in seven (15%) say their landlord charges them for rent and business rates in a single recurring bill, meaning they risk missing out on cash grants linked to the payment of rates.

The Government has now launched a discretionary fund aimed at helping those faced with this situation, though the vast majority (81%) do not know what share of their single charge is accounted for by rates, making it difficult for them to establish what, if anything, they might be due.

Close to one in 10 (8%) business owners have applied for universal credit, with close to a third (29%) having their applications rejected. Even amongst those that’ve had applications approved, less than one in seven (13%) have received their advanced payment.

Meanwhile, of those small business owners that say they are not using the Self-Employed Income Support Scheme (SEISS), the majority (68%) say this is because they are directors of limited companies. FSB continues to make the case for support for those excluded from existing grant schemes, including by calling for increased access to improved local hardship funds.

Chris Manka added: “The support measures that we’ve secured are helping the vast majority, but they’re not helping absolutely everyone. We’re hearing from business owners who are falling through the cracks and taking their stories straight to the top of government. Policymakers need to be in listening mode and prepared to help the most vulnerable over the challenging months ahead. No one should be left behind.”

Pictured - FSB’s NW Regional Chair Chris Manka

Ten arrested for drugs offences following warrants in Chester

Ten arrested for drugs offences following warrants in Chester

Ten arrested for drugs offences following warrants in Chester

Ten arrested for drugs offences following warrants in Chester

Suspended prison sentence and indefinite ban for Cheshire man who abused his dog

Suspended prison sentence and indefinite ban for Cheshire man who abused his dog

Recovered Stolen Items

Recovered Stolen Items

Man charged in relation to courier fraud

Man charged in relation to courier fraud

Police to target criminal use of Cheshire’s roads

Police to target criminal use of Cheshire’s roads

Council awarded Gold Armed Forces Award

Council awarded Gold Armed Forces Award

Appeal for footage and witnesses following collision in Delamere

Appeal for footage and witnesses following collision in Delamere

Appeal for information following serious collision in Chester

Appeal for information following serious collision in Chester

Your chance to get involved in police scrutiny meetings

Your chance to get involved in police scrutiny meetings

New Events at Jodrell Bank

New Events at Jodrell Bank

Inspiring Futures at The Queen’s School

Inspiring Futures at The Queen’s School

Bowmere Hospital celebrates 20 years of mental health care

Bowmere Hospital celebrates 20 years of mental health care

Man charged with burglary and drug offences following Chester police stop check

Man charged with burglary and drug offences following Chester police stop check

Vicars Cross Road closed following collision in Chester

Vicars Cross Road closed following collision in Chester

Man jailed for controlling and coercive behaviour and assault

Man jailed for controlling and coercive behaviour and assault

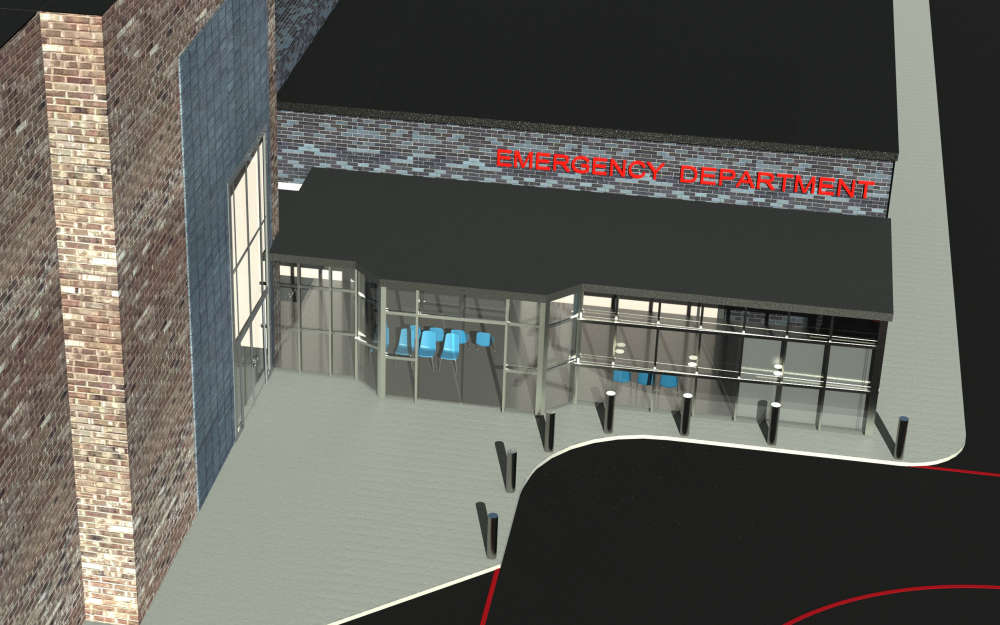

Plan unveiled to transform and improve emergency care at Countess of Chester Hospital

Plan unveiled to transform and improve emergency care at Countess of Chester Hospital

Chester & Wirral Football League - Weekend Round Up

Chester & Wirral Football League - Weekend Round Up

Ladbrokes returns to Chester Racecourse

Ladbrokes returns to Chester Racecourse