Tax credits customers should be vigilant and alert to potential scams, HM Revenue and Customs (HMRC) has warned, as the remaining annual renewal packs will arrive in the post this week.

In the 12 months to 30 April 2021, HMRC responded to more than 1,154,300 referrals of suspicious contact from the public. More than 576,960 of these offered bogus tax rebates.

In the same period, HMRC has worked with telecoms companies and Ofcom to remove more than 3,000 malicious telephone numbers and with internet service providers to take down over 15,700 malicious web pages. HMRC responded to 443,033 reports of phone scams in total, 135% up on the previous year.

Anyone doing their tax credits renewal who has received a tax or benefits scam email or text might be tricked into thinking it was from HMRC and share their personal details with the criminals or even transfer money for a bogus overpayment.

HMRC’s Cyber Security Operations identifies and closes down scams every day. The department has pioneered the use in government of technical controls to stop its helpline numbers being spoofed, so that fraudsters can no longer make it appear that they are calling from those HMRC numbers.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“We’re urging all of our customers to be really careful if they are contacted out of the blue by someone asking for money or bank details.

“There are a lot of scams out there where fraudsters are calling, texting or emailing customers claiming to be from HMRC. If you have any doubts, we suggest you don’t reply directly, and contact us yourself straight away. Search GOV.UK for our ‘scams checklist’ and to find out ‘how to report tax scams’.”

Many scams mimic government messages to appear authentic and reassuring. HMRC is a familiar brand, which criminals abuse to add credibility to their scams.

If customers cannot verify the identity of a caller, HMRC recommends that you do not speak to them. Customers can check GOV.UK for HMRC’s scams checklist to find out how to report tax scams and for information on how to recognise genuine HMRC contact.

Tax credits help working families with targeted financial support, so it is important that people don’t miss out on money they are entitled to. Customers have until 31 July to notify HMRC of any change in circumstances that could affect their claims.

Renewing online is quick and easy. Customers can log into GOV.UK to check on the progress of their renewal, be reassured it is being processed and know when they will hear back from HMRC. Customers can also use the HMRC app on their smartphone to:

- renew their tax credits

- check their tax credits payments schedule, and

- find out how much they have earned for the year

Tax credits customers must report the changes to HMRC. Circumstances that could affect tax credits payments include changes to:

- living arrangements

- childcare

- working hours, or

- income (increase or decrease)

Customers do not need to report any temporary falls in their working hours as a result of coronavirus. They will be treated as if they are working their normal hours until the Coronavirus Job Retention Scheme closes.

Ten arrested for drugs offences following warrants in Chester

Ten arrested for drugs offences following warrants in Chester

Ten arrested for drugs offences following warrants in Chester

Ten arrested for drugs offences following warrants in Chester

Suspended prison sentence and indefinite ban for Cheshire man who abused his dog

Suspended prison sentence and indefinite ban for Cheshire man who abused his dog

Recovered Stolen Items

Recovered Stolen Items

Man charged in relation to courier fraud

Man charged in relation to courier fraud

Police to target criminal use of Cheshire’s roads

Police to target criminal use of Cheshire’s roads

Council awarded Gold Armed Forces Award

Council awarded Gold Armed Forces Award

Appeal for footage and witnesses following collision in Delamere

Appeal for footage and witnesses following collision in Delamere

Appeal for information following serious collision in Chester

Appeal for information following serious collision in Chester

Your chance to get involved in police scrutiny meetings

Your chance to get involved in police scrutiny meetings

New Events at Jodrell Bank

New Events at Jodrell Bank

Inspiring Futures at The Queen’s School

Inspiring Futures at The Queen’s School

Bowmere Hospital celebrates 20 years of mental health care

Bowmere Hospital celebrates 20 years of mental health care

Man charged with burglary and drug offences following Chester police stop check

Man charged with burglary and drug offences following Chester police stop check

Vicars Cross Road closed following collision in Chester

Vicars Cross Road closed following collision in Chester

Man jailed for controlling and coercive behaviour and assault

Man jailed for controlling and coercive behaviour and assault

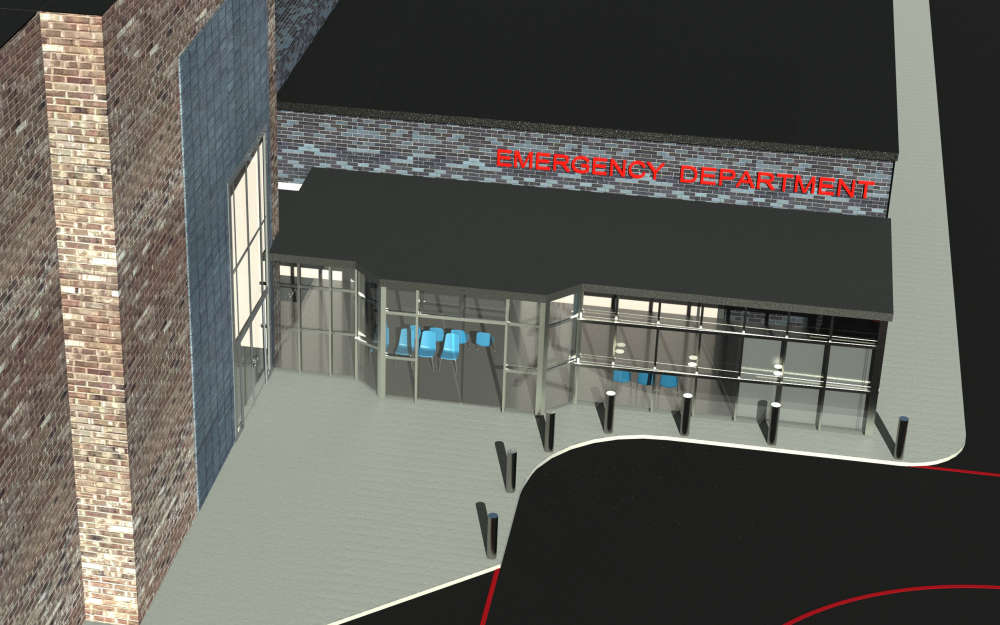

Plan unveiled to transform and improve emergency care at Countess of Chester Hospital

Plan unveiled to transform and improve emergency care at Countess of Chester Hospital

Chester & Wirral Football League - Weekend Round Up

Chester & Wirral Football League - Weekend Round Up

Ladbrokes returns to Chester Racecourse

Ladbrokes returns to Chester Racecourse

Comments

Add a comment